Click here to read Part 1.

#3: Narrative Performance Reporting takes the spotlight

Narrative Performance Reports (NPR) provides context to metrics found in an organization’s financial performance and business plans — the “story-behind the numbers”. Annual and quarterly earnings reports are the most common NPRs, but this can also include reports and presentations to internal management, board, investors, creditors, other regulatory bodies.

Generating NPRs using a combination of external third parties, traditional word processors and presentation programs that are disconnected from the required source data is dangerous. Key metrics are particularly prone to undetected error or misrepresentation as it is commonly referenced in multiple reports often prepared by different individuals or groups in an organization. Click here for our take on the top 10 challenges in Narrative Performance Reporting.

A lot of time, money, and effort are spent on ensuring numbers are correct as data leaves its transaction systems (e.g., ERPs) and are collated and consolidated in Financial Consolidation and Budget systems. Yet the NPRs that ultimately get presented to stakeholders often entail ‘cut-and-paste’ of myriads of word documents, spreadsheets, and power point presentations prepared by different individuals at different times most likely corresponding through fragmented email chains. The pre-final product is then reviewed by more eyes to ensure accuracy and information integrity than those to ensure the proper supporting context is provided.

With expanding reporting mandates and need for shorter reporting timelines, improving Narrative Performance Reporting processes has become a top priority for Office of the CFO and the broader organization.

This is the fundamental problem that Narrative Performance Reporting solutions seek to address. These solutions started emerging at the start of this decade led by Clarity FSR and WebFilings.

Clarity FSR went on to being acquired by Cognos who was then later acquired by IBM. In 2017, with IBM re-focusing their efforts on Cognitive Analytics and Cloud Computing, they allowed Certent, with 15 years in the disclosure management space, to acquire that solution and strengthen their overall Narrative Performance Reporting solution and service offering. Under Certent, the Clarity FSR solution was re-branded to Certent Disclosure Management (“CDM”).

WebFilings launched their cloud-based product called WDesk initially focused on enabling companies to streamline their SEC filing (including XBRL reporting). In 2014, WebFilings became a public company traded on the New York Stock Exchange as Workiva and began extending its capabilities beyond SEC Filing into the broader Narrative Performance Reporting solution space.

TGG TIP: When evaluating Narrative Performance Reporting solutions, consider the following:

- Information Security: Organizations that have concerns in storing its sensitive business data (especially Material Non-Public Information) outside its internal network should seek to better understand a solution’s security protocols and standards (e.g., ISO27001 certified, tighter end-point security, etc.).

- User Adoption: Some solutions offer its own proprietary publishing software while others leverage existing third party products. This can impact user adoption (e.g., familiarity of tools), but can also be an opportunity for deeper enhancements.

- Integration: These solutions offer varying degrees of integration options. Ensure that the method and degree of integration with your source data systems meets your requirements.

- Data Model: Ensure to spend sufficient time to establish the appropriate data model that will be used to support your Narrative Performance Reports (e.g., to avoid duplication of data, etc.)

#4: Increased focus on Integrated Planning

While the adoption of FP&A solutions have become widespread, few organizations have achieved true integrated planning — where the organizations no longer need to shut down for several months to devote time into developing budgets and forecasts, and that the business is able to gain transparency over the impact of actual results across the organization and proactively change plans as required (e.g., alter production plans when sales are falling short, etc.). Through an informal poll of our clients, some are citing the following as impediments to achieving Integrated Planning:

- Differentiating between budgets against financial reporting data versus management accounting data.

- Access to timely and quality data (e.g., handling allocations in accounting records create challenges in conducting value driver analysis).

- Separate budgeting processes and ownership for balance sheet, cash flow, and income statement plans.

- Over reliance on spreadsheets and disparate planning tools.

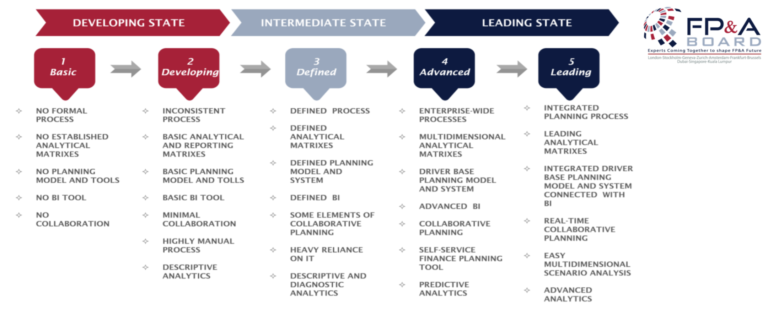

The FP&A Analytics Maturity Model shown below by the International FP&A Board is a great way to quickly visualize where your organization’s FP&A efforts are at and what goals to set to achieve integrated planning.

TGG TIP: Think big. Start small. Scale fast.

- Common Ground: Key to integrated planning will be establishing the common foundation that applies across business units and functions — this speaks to how inter-dependencies between plan elements are developed, communicated, and analyzed. The next generation of budgeting / planning platforms will allow for local unit level planning while supporting the macro orchestration of plans.

- Deeper Analytics: Operations typically need to plan at a much lower granularity with a higher velocity (e.g., construction and manufacturing often require ‘up-to-the-minute’ insight on current production as well as plan for impact of upcoming jobs). Tighter integration with these operational systems and the enterprise planning platforms will support more timely and deeper analytics to further streamline the planning processes.

What CPM & EPM trends have you seen? How will your organization respond to these trends?